AHSEC| CLASS 12| ACCOUNTANCY| SOLVED PAPER - 2022| H.S. 2ND YEAR

2022

ACCOUNTANCY

Full Marks: 100

Pass Marks: 30

Time: Three hours

The figures in the margin indicate

full marks for the questions.

1. (a) Fill in the blanks with appropriate word/words: (any four)

(i) Income

and Expenditure Account is prepared on an

accrual basis. 1

(ii)

Liability of a partner is unlimited. 1

(iii) Annual

Report is issued by a company to its Shareholder. 1

(iv) Liquid

ratio is the relationship between Liquid Assets

and current liabilities. 1

(v) Equity

shareholders are members of a

company. 1

(b) Choose

the correct alternative:

(i) When a

new partner is admitted - 1

(a) Consent of

all the partners is required.

(b) Consent of

majority of the partners is required.

(c) Consent of

any one partner is required.

Ans:- (a) Consent of all the partners is required.

(ii) Balance

of shares forfeited account after re-issue is transferred to – 1

(a) Reserve

Fund

(b) Profit and

Loss Account

(c) Capital

Reserve

Ans:- (c) Capital Reserve

(c) State

whether the following statements are “True” or “False”: (any two)

(i)

Outstanding subscription is an asset.

1 True.

(ii) A

Preference Shareholder gets interest at a fixed rate. 1 False.

(iii)

Company’s shares are generally transferable. 1

True.

(iv) Life

membership fee is a capital receipt.

1 True.

2. Mention two features of a not-for-profit

organisation. 2

Ans:- The main two characteristics of non-profit

organizations are:

(i) Main

objective is service: Such organizations are set up to provide service to a

specific group or public at large either free of cost or at nominal rates and

not to earn profit.

(ii) Separate

entity: The non-profit organization is treated as a separate entity from

its members.

3. What is Profit and Loss Appropriation Account? 2

Ans:- In partnership, the profit is divided among the

partners in a fixed profit sharing ratio, as stated in the partnership deed,

after making necessary adjustments such as interest on capital, drawings and

loans to partners, salaries, commission, etc. These transactions should not be

mixed with other normal business transactions as they are appropriation of

profit in the sense that if they are not distributed in the form of salary,

interest, commission etc., they are distributed as profit.

4. What is the meaning of Cash Flow from Financing

Activities? 2

Ans:- Cash flow from financing activity measures the

movement of cash between a firm and its owners, investors and creditors. This

report shows the net inflow of funds used to run the company including debt

equity and dividends.

5. Mention any two features of a debenture. 2

Ans:- Two Features of debentures:

(i) Acknowledge.

(ii) Holder are creditors.

6. Mention any two rights of a partner. 2

Ans:- Two rights of partners:

(i) The partners

are entitled to have access to the books of accounts of the firm and to take

copies of the same.

(ii) Every

partner has a right to participate in the conduct and management of the

business.

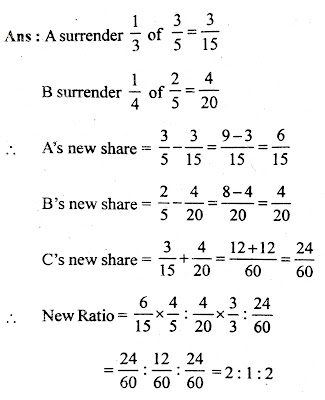

7. A and B are partners sharing profit and losses in the

ratio 3:2 C is admitted into the partnership. A surrendered 1/3rd of

his share and B surrendered 1/4th of his share in favour of C.

Determine the new profit-sharing ratio.

3

Or

Write three

distinctions between Fixed Capital Account and Fluctuating Capital Account.

Ans:- The

differences between fixed and fluctuating capital are:

|

Basis |

Fixed

capital account |

Fluctuating

capital account |

|

Change in capital |

Except in exceptional circumstances, the balance in capital accounts usually

remains unchanged during the life of the business. |

When capital fluctuates, the balance in the capital accounts changes

from time to time. |

|

Number of accounts |

When capital is fixed, each partner has two accounts, the capital

account and the current account. |

When capital fluctuates, each partner has only one account, namely,

the capital account. |

|

Recording of transactions |

When capital is fixed, the transactions relating to withdrawals,

interest on capital, etc., are not made in the capital account but are

recorded in a separate current account. |

In this case all the transactions relating to the partners are done

directly in the capital itself. |

8. Explain three uses of financial statement. 3

Ans:- Three Uses of Financial Statements:

(i)

Determining the financial position of the business: The most important use

of financial statements is to provide information about the financial position

of the business at a given date. This information is used by various

stakeholders to take important decisions regarding the business.

(ii) To

obtain credit: Financial statements present the picture of the business to

the potential lenders and this information can be used by them to provide

additional credit for business expansion or to restrict credit so that recovery

starts Could

(iii) Helps

investors in taking decisions: Financial statements contain all the

necessary information required by the potential investors to determine how much

they want to invest in the business. It is also helpful in taking a decision

regarding the per share price that investors want to invest in. A good

financial statement is the key to getting investments.

9. Mention any three objectives of preparing Comparative

Statement. 3

Ans:- Three objectives of preparing comparative

statement:

(i) Better

understanding: Simple and comparative presentation of data makes the

message of financial statements easily understandable to the management.

(ii) Indirect

Tendency: The comparative statements give information about the change that

affects the financial statements and performance of the firm. It is the

indicator of trend which helps the management to predict the future.

(iii) Focus

on Strength and Weakness: It focuses on the strengths and weaknesses of the

enterprise and draws the attention of the management to take remedial measures

for the weak areas.

Or

A company’s

stock is Rs. 2,00,000. Total liquid assets are Rs. 8,00,000 and quick ratio is

2:1. Calculate current ratio.

Ans:- Quick ratio = LA/CL

2 = 8,00,000/CL

CL = 4,00,000

Current Assets =

4,00,000+2,00,000=6,00,000

10. Explain the following terms: 3

(i) Capital

Fund

Ans:- In

the case of non-trading organization, the term capital fund is used instead of

capital. It is sometimes called General Fund or Consolidated Fund or Corpus

Fund. It is the excess of assets over liabilities on a particular data.

(ii) Life

Membership Fee

Ans:- It

is a receipt of capital nature as the members will not be required to pay

annual fee, so it should be added to the capital fund or shown separately on

the liabilities side of the balance sheet.

(iii)

Entrance Fee

Ans:- In

the absence of any specific direction; Entry fee can be treated as revenue

receipt and thus shown on the credit side of the Income and Expenditure

Account. However, if any direction is given to treat it as capital gain then it

should be shown on the liability side of the Balance Sheet of the current year.

Or

Write three

features of Fund Based Accounting.

Ans:- Fund

based accounting has three features:

(i) Opening

of a separate fund account: When a donation is received for a specific

purpose, a separate fund account is created in the name of the specific purpose

such as building fund, prize fund, etc. Such fund account is shown on the

liabilities side. side of the balance sheet.

(ii) Income

received on investment of specific fund: If the money of the fund is

invested, the income received from the investment of such fund is credited to

that fund account and not to the Income and Expenditure Account.

(iii) New

donation relating to a specific fund: Any new donation or receipt on such a

specific fund should be deposited in that fund.

Or

Calculate the

amount of stationery consumed to be shown in the Income and Expenditure A/c for

the year ended 31st December, 2020-

|

|

01-01-2020 |

31-12-2020 |

|

Creditors for

stationery |

4,000 |

6,200 |

|

Stock of

stationery |

5,400 |

5,000 |

During the

year 2020 payment made for stationery was Rs. 40,000.

Ans:-

Stationary consumed to be shown in

Income and Expenditure A/c

|

Particulars |

Amounts |

|

Opening

stationary Add:

Payment made for stationary Less:

Closing stationary Less:

Opening Creditor Add:

Closing creditor |

5,400 40,000 |

|

45,400 5,000 |

|

|

40,400 4,000 |

|

|

36,400 6,200 |

|

|

42,600 |

ACCOUNTANCY SOLVED PAPERS PAGE LINK - Click here

BUY E-BOOK (PDF FILE)

[TO SEE FULL SOLUTION]

(Chapter wise Notes, Exam Question Papers solved, MCQ solved) [ARTS, COMMERCE, SCIENCE]

|

DOWNLOAD PAGE LINK:-CLICK HERE |

AHSEC PAGE LINK - CLICK HERE